The financial pressures in the aftermath of a car accident are thrust upon you right away. You’re hit with emergency room charges, ambulance fees, X-rays, medications, and specialist visits, often within the first 48 hours.

For people with serious injuries, the medical costs will not stop for weeks, months, or even years. Rehab, surgeries, mobility equipment, and long-term care continue to add up fast. These bills are not just a hit to your wallet, they can be confusing and emotionally overwhelming.

Knowing the real cost of post-accident care is the first step. Once you understand what you’re facing financially, you can figure out who pays, what your insurance covers, and how to protect yourself if those bills go beyond the limits of any policy.

If you’ve been in a recent car crash in the Sacramento area and you’re already facing bills you can’t manage, call 1.844.734.2626 for a free case review. We don’t get paid unless you do.

What is the average cost of medical bills after a car accident?

The average cost of medical bills after a car accident ranges from $3,000 to $5 million or more, depending on the severity of the injuries and the type of treatment required.

According to the National Highway Traffic Safety Administration (NHTSA), the average injury claim in the U.S. is around $15,000, but that number only accounts for basic injuries. Severe injuries and long-term disabilities often lead to settlements in the hundreds of thousands or even millions.

In California, a single ER visit usually costs between $3,300 and $7,500. Surgery can cost over $55,000, and inpatient rehab may add another $20,000. Diagnostic imaging like MRIs ranges from $2,000 to $4,000, and physical therapy often runs $150 per session. These expenses stack up fast, especially when the recovery is long or complicated.

Realizing the full cost of care after an accident can be dizzying and frustrating, but we’re here to guide you through the chaos and get you the assistance you need.

Who pays for medical bills after a car accident

Medical bills after a car accident are typically covered by a mix of auto insurance, health insurance, and the at-fault driver’s liability coverage, depending on the details of the crash and the policies involved.

Each type of coverage comes with its own limits, timelines, and claim requirements. Knowing how to coordinate these benefits correctly can be the difference between paying your bills and falling into debt.

Sorting through these options can be confusing, but you don’t have to do it alone. Let’s break down how each type of coverage applies and how they work together to help pay your medical bills after a car accident.

When does auto insurance coverage pay for medical bills?

In California, your auto insurance pays medical bills through MedPay if you’ve added it to your policy. MedPay covers emergency care, diagnostics, and follow-up treatment up to your policy limit, usually between $1,000 and $10,000.

It applies regardless of who caused the crash and pays faster than a third-party claim. To access it, file a claim with your insurer and submit your medical records and bills on time.

Unlike no-fault states that use Personal Injury Protection (PIP) insurance, California drivers rely on MedPay for early help with medical costs.

When does an at-fault driver’s insurance pay for medical bills?

The at-fault driver’s insurance pays your medical bills after liability is proven and a settlement is reached. This process takes time because insurers must investigate the crash and determine who is at fault.

But this route is often your primary path to full compensation, especially for serious injuries. Keep all records organized, and don’t accept early offers to settle from any insurer without speaking to a lawyer.

Your lawyer can help gather evidence and negotiate with the insurer if liability is disputed.

When does health insurance cover car accident injuries?

Private health insurance covers your car accident injuries if another driver was at fault. You can use your plan for hospital care, surgery, physical therapy, and prescriptions, just like you would for any other injury. But it doesn’t mean everything is paid in full; you’re still responsible for deductibles, copays, and out-of-network charges.

Most health plans pay the bills up front, but later demand reimbursement from your settlement. This process is called subrogation, which is commonly outlined in policy terms.

Your health insurance company has the right to seek repayment if outlined in your policy, but that amount can often be reduced with legal help. At JG Winter, we can help reduce what you owe and make sure medical liens don’t take more than they should.

When does third-party liability pay for medical bills?

Third-party liability pays your medical bills when someone other than a driver is legally responsible for the crash. This can include an employer, a rideshare company, or even a vehicle manufacturer.

- Employer liability applies when the person who caused the crash was performing job duties at the time of the accident.

- Rideshare companies like Uber and Lyft provide commercial coverage that applies when their drivers cause a crash while on the job.

- Manufacturers are held responsible when a vehicle defect, such as brake failure or airbag malfunction, directly causes the accident.

These claims take more investigation, but they unlock higher insurance limits. Our personal injury attorneys help identify third-party responsibility and build the case to recover full medical costs.

Who pays the bills if you were a passenger?

Suppose you were injured as a passenger in a car accident. In that case, your medical bills may be covered by the driver’s insurance, the at-fault party’s insurance, or your own health insurance, depending on who was responsible for the crash.

In many cases, you can recover through more than one policy.

- Passengers injured by a negligent driver can file a liability claim under that driver’s auto insurance policy.

- When another driver is at fault, their insurance is responsible for covering your medical expenses through a third-party claim.

- In shared-fault accidents, passengers are legally allowed to seek compensation from both insurance policies involved.

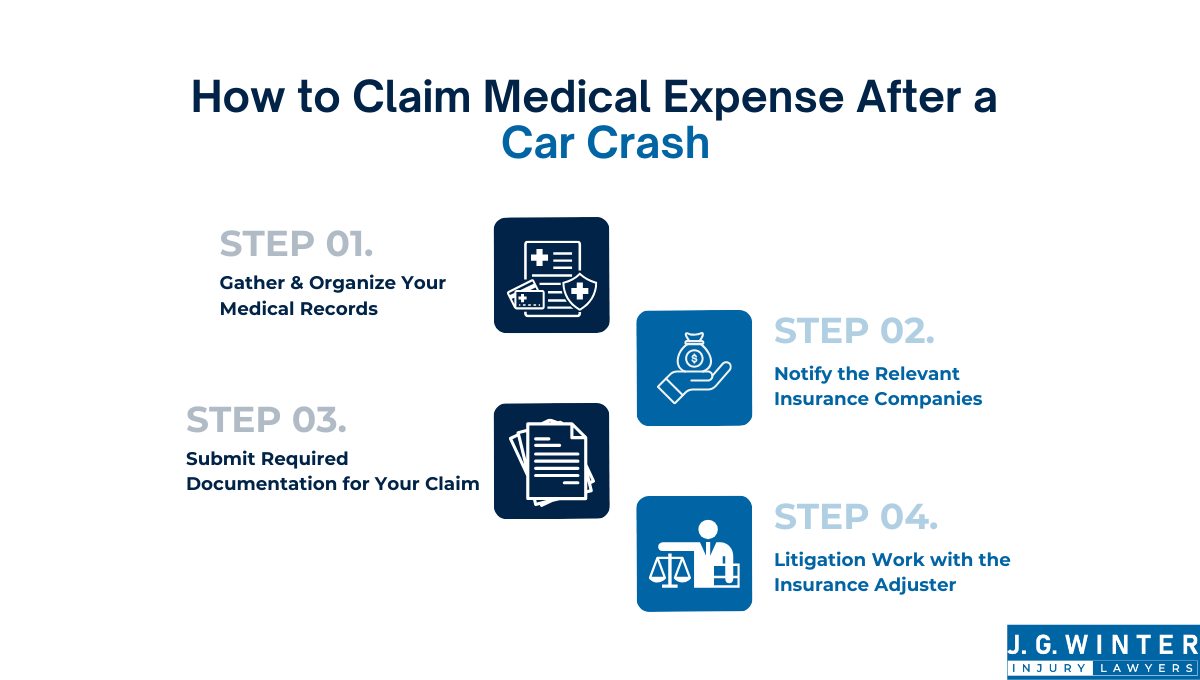

How to claim medical expenses after a car crash

You must act fast and follow the right steps to claim medical expenses after a crash. How you document your treatment and communicate with the insurance company directly affects what gets paid. Here’s a step-by-step breakdown:

Step 1. Gather & organize your medical records

Your medical records are the foundation of your claim; they prove what happened, what treatment you needed, and how much it cost. Collect every record from the ER, urgent care, specialists, and physical therapy providers, including bills, diagnostic results, treatment notes, and prescriptions.

These documents show the full impact of your injuries and help support the value of your case. At JG Winter Law, we review every page carefully to make sure nothing gets missed and to build the strongest claim possible from day one.

Step 2. Notify the relevant insurance companies

You must notify all relevant insurance companies, including your auto insurer, the at-fault driver’s insurer, and possibly your health provider, as soon as possible. Most policies require notice within 24 to 72 hours of the crash.

Step 3. Submit required documentation for your claim

Insurance companies require specific documents to process your medical claim. Send your paperwork through the submission method listed in the policy, usually email, online portal, or certified mail.

Be sure to include:

- Medical bills with treatment dates, provider info, and itemized charges

- Medical records showing diagnoses, procedures, and recovery plans

- Accident report from the police or California Highway Patrol (CHP)

- Insurance policy numbers for all involved parties

- Proof of lost wages if injuries kept you from working

As one of Northern California’s most trusted law firms for auto accident claims, we will help you organize and send everything correctly so your claim isn’t delayed or denied.

Step 4. Work with the insurance adjuster

Talking to an insurance adjuster while you’re in pain or overwhelmed is never easy. They might seem helpful, but their priority is protecting the insurance company, not your recovery. Their goal is to minimize what they pay, not maximize what you receive.

Stick to the facts, avoid guessing, and don’t downplay your injuries, even if you’re trying to be polite. Give them clear records and keep notes of every call or message.

Let us step in so you don’t have to go through this alone. We handle the adjusters, manage the paperwork, and make sure your injuries are fully recognized, because you deserve to focus on healing, not negotiating.

Step 5. Handle claim denials or delays

A denied or delayed claim doesn’t mean the fight is over; it just means you must push back with the right steps. Start by requesting the reason for the denial in writing and reviewing your policy line by line.

You can file an appeal, submit updated records, or escalate the issue to California’s Department of Insurance if needed. Insurers often count on you giving up, but we won’t let that happen.

Our attorneys challenge wrongful denials and delays every week, and we do it with urgency because we know your medical bills can’t wait.

How to handle medical bills if they exceed insurance policy limits?

If your medical bills exceed insurance limits, you’re not out of options. We’ll fight to recover what your insurance doesn’t cover, because making sure you obtain the full cost of your recovery shouldn’t be your burden.

In California, the minimum liability coverage is only $15,000 per person, often far less than the cost of serious injuries. If that’s not enough, you may still have options through your uninsured/underinsured motorist coverage or by pursuing a legal claim against the at-fault driver or another responsible party.

Who covers medical expenses beyond insurance coverage?

When insurance limits are exhausted, the remaining medical bills become your out-of-pocket expenses unless you take legal steps to recover more. These unpaid costs often include extended hospital stays, surgeries, rehab, and future care.

At that point, the legal responsibility can shift to the at-fault driver or another liable party. Your options include filing a personal injury lawsuit, negotiating directly with the liable party, or extending the current settlement through structured payouts.

We explore every recovery path available so your care isn’t left unpaid, and your future isn’t left uncertain.

How to handle medical bills from an uninsured motorist

Uninsured motorist (UM) and underinsured motorist (UIM) coverage pays your medical bills when the at-fault driver has no insurance or not enough to cover your care. These policies are optional in California, but highly valuable when the other driver is unable to pay.

You can file a UM or UIM claim through your auto insurance to cover emergency care, hospital stays, and follow-up treatment. This works like a liability claim, but it’s handled by your insurer instead of the other driver.

Legal action becomes necessary when no coverage exists or when your insurance denies the claim. If that happens, we will take every possible step to recover what you’re owed because no one should pay out-of-pocket for someone else’s negligence.

How to manage medical bills while waiting for a settlement

When your case is still open, but the hospital bills keep coming, the pressure on you and the disruption to your daily routine can be intense. It’s not unusual to receive collection notices while you’re still recovering and still waiting for insurance to pay.

To avoid going into debt before your case resolves, you can delay payments using legal tools that hold your bills until the settlement comes in.

Can you delay paying medical bills until settlement?

Yes, you can delay medical bills through legal agreements that give you time to settle your case. The most common tools are medical liens, letters of protection, and payment holds, which are negotiated by your attorney.

A medical lien allows your provider to wait for payment until your settlement is finalized. With a letter of protection, your lawyer guarantees payment from your future recovery. Some providers will also agree to temporary holds if they know a claim is in progress.

Can you reduce medical bills after an accident

Yes, you can reduce most medical bills after an accident through negotiation, financial hardship requests, or legal intervention. Hospitals and providers often lower charges if payment is delayed or if the total exceeds what insurance will cover.

You can ask for an itemized bill, challenge duplicate or inflated charges, and request a hardship discount if you’re unable to pay the bill. Some providers have financial aid programs you can apply to, even after treatment.

How can medical bills maximize compensation for car accident settlement

Medical bills do more than track what you owe; they prove what you’ve been through. Every documented charge helps establish the seriousness of your injuries, the length of your recovery, and the financial impact the crash has had on your life.

Well-organized records can increase your settlement by showing the insurer a clear picture of your pain, treatment, and ongoing needs. Total costs, provider notes, and consistent care all help justify a higher payout. Generally, up to 75% of the settlement value is tied to documented medical care.

The better your medical documentation, the harder it becomes for the insurance company to undervalue your suffering or delay what you’re rightfully owed.

How lawyers’ negotiation affects your compensation

An experienced lawyer doesn’t just submit your medical records; they build a compelling, evidence-based demand that fully reflects your losses. This includes bundling bills, treatment notes, diagnostics, and future care estimates into a complete picture of your losses.

Insurance companies often undervalue claims or try to shift the blame. A skilled attorney pushes back, challenges lowball offers, and knows how to go beyond what’s initially on paper and negotiate for pain and suffering, lost future income, and expectation for long-term care.

Strong legal negotiation can turn an undervalued offer into a complete recovery, and the right lawyer won’t stop until you get the justice you deserve.

How JG Winter Law can help you recover medical bills

At JG Winter Law, we do more than file claims; we help our clients rebuild. Our team has recovered over 1.5 million for California car accident victims, including hundreds of thousands in unpaid medical bills.

Our founder, Jeremy G. Winter, became a personal injury attorney after losing his own mother in a tragic crash. That experience drives how we treat our clients, like people, not case files. We handle every call with compassion and fight every claim with purpose.

Call +1.916.702.7870 for a free consultation today. You pay nothing unless we win your case.