Losing someone you love is heartbreaking. While receiving a settlement can provide some financial relief, it often brings new questions, especially about taxes. This can make an already hard time even more stressful. This guide explains California’s tax rules regarding wrongful death settlements, helping you understand what to expect. Let’s take a closer look at the question: are wrongful death settlements taxable?

What are wrongful death settlement damages?

Wrongful death settlement damages compensate the family of someone who has died due to another’s negligence. These funds help the family manage the financial and emotional losses resulting from their loved one’s death.

Are there areas where wrongful death settlements are taxable?

While wrongful death settlements are generally not taxable in California, taxes apply in certain areas. Here are some areas where wrongful death compensation is taxable:

Punitive damages

Punitive damages awarded in a wrongful death settlement are usually taxable. This damage is meant to punish the person who caused the death rather than compensate the victim’s family for their loss. The Internal Revenue Service (IRS) considers punitive damages as a punishment or windfall, categorizing them as taxable income under federal law.

California state law generally aligns with federal guidelines, but consulting a Wrongful Death attorney is crucial to understanding your case’s tax implications.

Schedule a free consultation to understand the tax details. Call us now at 844-734-2626.

Emotional distress or pain and suffering

The government usually does not tax compensation for pain and suffering that results from a physical injury in a wrongful death lawsuit.

However, if the emotional distress isn’t connected to any physical injury—like the grief a family feels after losing a loved one—it can be considered taxable income. This rule depends on how the IRS defines compensation for personal injuries or sickness versus other damages.

Medical costs deducted in previous years

If you previously claimed a tax deduction for medical expenses related to wrongful death, any reimbursement from the settlement might be taxable. This prevents a double benefit, where you save on taxes and then receive tax-free money. The government ensures that you do not profit from these claims.

To avoid problems, keep good records of any medical expenses you already claimed on your taxes. This will help you determine which part of your settlement might be taxable.

You should consult with a tax professional or attorney to understand the tax implications specific to your case and ensure compliance with federal and state tax laws.

How do I file a wrongful death lawsuit in California?

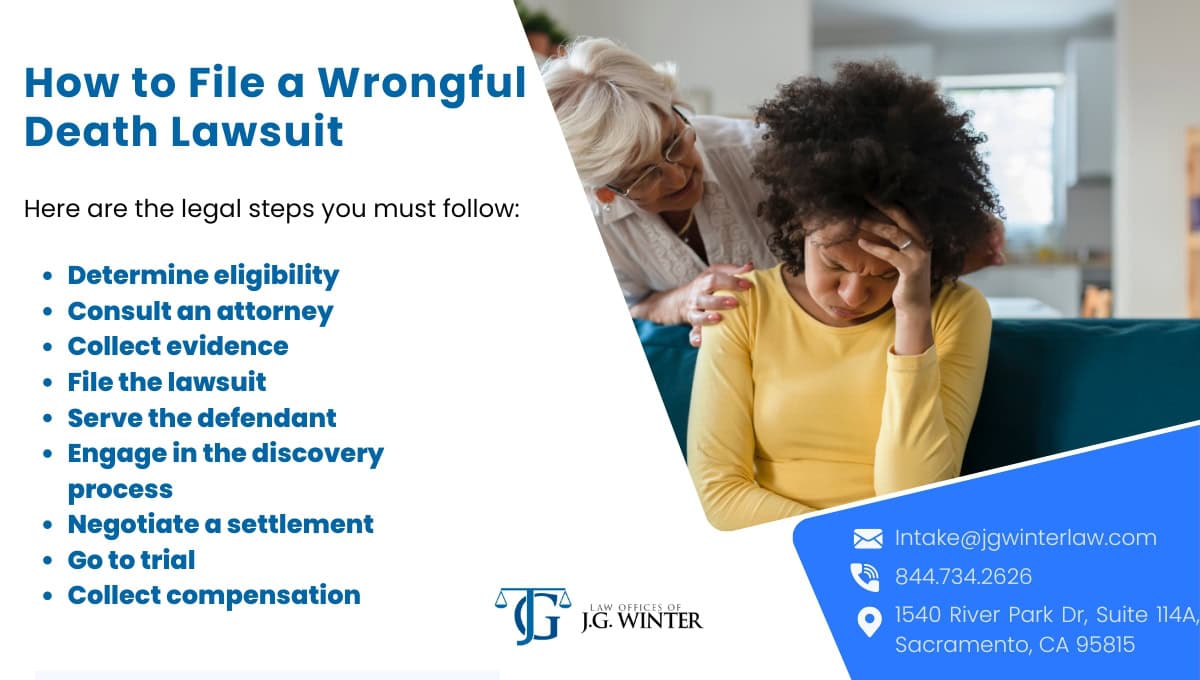

To file a wrongful death lawsuit in California, you must follow specific legal procedures and meet certain requirements. Here’s a step-by-step guide to help you through the process:

Determine eligibility to sue

Under California law, only certain individuals are eligible to file a wrongful death claim. These typically include the deceased person’s surviving spouse, domestic partner, children, and, in some cases, other family members or dependents who were financially dependent on the deceased.

Establish the basis for wrongful death

You must prove that the death was caused by the negligent, reckless, or intentional actions of another party. This could involve medical malpractice, car accidents, or criminal behavior.

Gather evidence

Collect as much evidence as possible to support your claim. This can include medical records, accident reports, eyewitness testimonies, and expert assessments. This evidence will be crucial in proving negligence or fault in causing the death.

Hire an attorney

Given the complexities of wrongful death claims, we advise you to hire an attorney like Attorney Jeremy Winter who is specialized in this law area. An experienced wrongful death attorney can help advise on the strength of your case and handle negotiations with defendants and insurance companies.

File a wrongful death complaint

Your attorney will draft and file a wrongful death complaint in the appropriate California court. This document outlines your relationship to the deceased, the facts of the case, the defendant’s alleged negligence, and the damages you are seeking.

Negotiate a settlement or go to trial

Many wrongful death cases are resolved through out-of-court settlements. If both sides agree on the amount, the case ends there. If they cannot agree, the case will go to trial, and a judge or jury will decide the outcome.

Collect the awarded compensation

If the court or settlement negotiations result in compensation for the wrongful death, the final step is collecting the awarded amount. If the defendant does not willingly pay, further legal action may be necessary.

Contact J.G. Winter Law, California-based wrongful death lawyer

If you’re dealing with the complexities of a wrongful death settlement and its tax implications in California, seeking expert legal guidance is crucial. Contact JG Winter Law today to ensure you have a personal injury case expert by your side to protect your rights. Don’t navigate these difficult waters alone. Let our experienced wrongful death attorneys at JG Winter Law help you understand your options and make informed decisions. Call us at 844-734-2626 for a FREE consultation session.